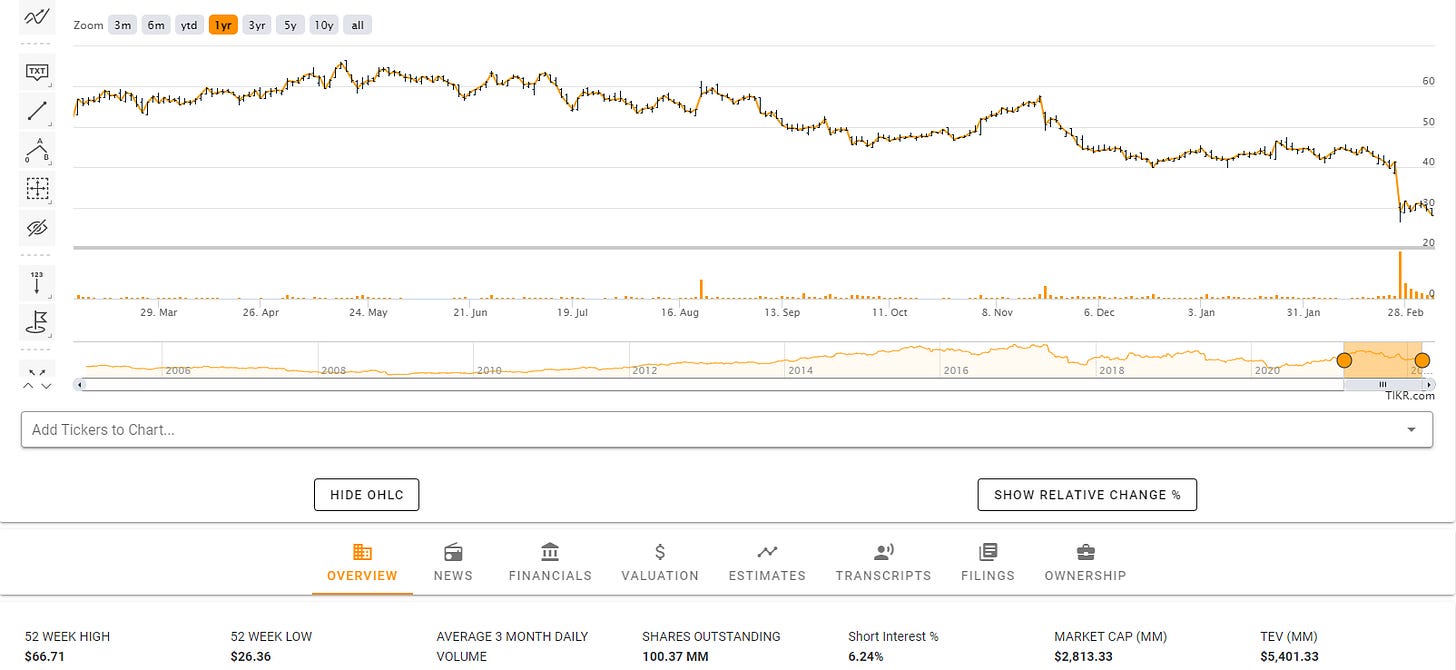

A major retailer with a 5% dividend, trading at 4 times EBTIDA and a P/E under 4 times, and P to free cash flow of 4? Wow!

Comparable businesses trade up to 33x P/E

Now before you get excited you should know that P/FCF means that you would double your money every 4 years. That may not happen that easily because the reason you are seeing this opportunity today, and those irrealistic numbers, is that they just lost a major gigantic partner. So that income, net income, and Free cash flow will likely fall. However, is still a great buy! The analysis below takes into account that so don’t worry.

Even with reduced prospects :

100 Million shares outstanding

2.8 billion market cap.

800 million in cash, 1.2B in easy-to-sell inventory.

Trading at 3 times EBTIDA and a P/E under 7 times.

5% dividend yield

They just authorized a $1.2 billion stock buyback, but couldn't start buying until a few days after reporting. This represents 42% of the current enterprise value ("EV")

low valuation won’t last for long

Look at these valuations:

Keep reading with a 7-day free trial

Subscribe to Start with the A's to keep reading this post and get 7 days of free access to the full post archives.