Is Alibaba ($BABA) a Worthy Investment? An In-depth Analysis

Alibaba, the e-commerce behemoth from China, has recently been a topic of much discussion in investment circles. With its stock plummeting by 70% from its all-time high of $320 per share, investors wonder if this is the right time to buy. In this blog post, we'll dive into the details and analyze the various aspects of Alibaba as an investment opportunity.

The Fall and Rise of Alibaba

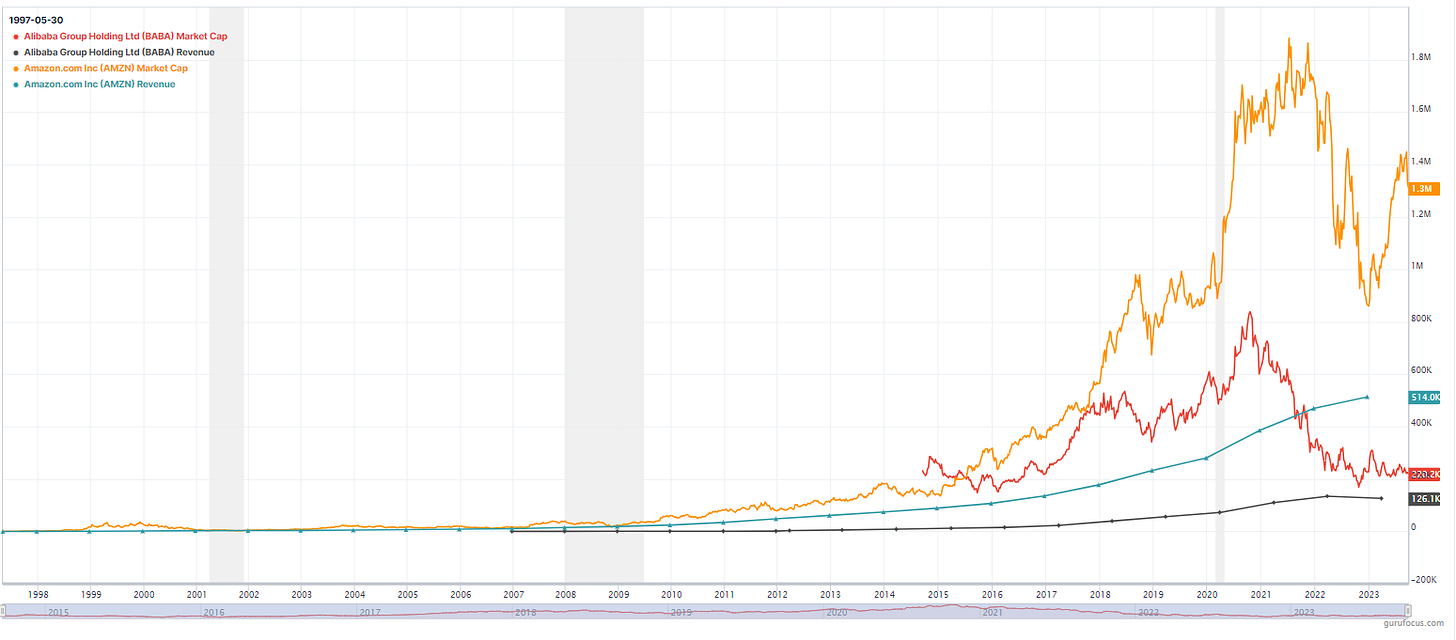

Over the years, Alibaba's stock performance has been quite a rollercoaster. While the stock has decreased by 70% from its peak, it must note that the company still boasts a market cap of $223 billion. Such numbers are not to be taken lightly, especially considering that the company's free cash flow for the last year was an impressive $29 billion.

Let me summarize all the factors to consider on the web, with my reasons for why this risk is worth taking.

Factors to Consider

Regulatory Concerns: Alibaba has recently faced increased regulatory scrutiny from the Chinese government. This oversight has made some investors nervous, but it's crucial to remember that such regulatory measures are not uncommon in rapidly growing economies.

Delisting Risks: There's been chatter about the potential delisting of Alibaba from U.S. stock exchanges. However, even in the event of a delisting, shares would likely get converted to Hong Kong shares, ensuring that investors don't lose their money.

Economic Slowdown: While the Chinese economy is witnessing a slowdown, it's important to remember that their idea of a 'recession' is a 4% growth, not the 8% growth they're accustomed to. Their recessions aren't as deep as what Western economies typically face.

The Chinese Middle Class: One of the most compelling arguments for investing in Alibaba is China's rapidly growing middle class. With the average income in China being $12,000 a year (compared to the U.S. average of $75,000-$80,000), there's a massive potential for growth. Plus, with five times the U.S. population and just one-sixth of the income, there is enormous room for economic expansion. However, China’s population is shrinking fast!

China has shown signs of economic, political, and societal breakdown.

Consumer spending and lending in China have decreased.

High-ranking officials, like the foreign and defense ministers, have gone missing or been dismissed.

China has stopped collecting data on youth unemployment, bond transactions, and patents.

The birth rate in China has dropped by nearly 70% since 2017, the fastest in human history.

China's population might have been overcounted by over 100 million people, all of whom would have been of working age.

China's industrial competitiveness is declining.

The Biden Administration is highly protectionist, posing challenges for China.

Chairman Xi Jinping's purges have left the political system vulnerable.

The reshoring trend in the U.S. is significant, but there's concern about the dependency on Chinese-made industrial equipment.

The biggest risk is the potential shortage of products from China, which could impact global industries.

The Bullish Perspective

Several positive aspects make Alibaba a promising investment:

Diverse Business Model: Alibaba is not just an e-commerce platform. The company has diversified into six sectors, offering various services and products.

Strong Financial Performance: Despite the stock's downturn, Alibaba consistently showcases profitability and strong free cash flow.

Regulatory Easing: Recent developments suggest that the Chinese government has started easing some of its restrictions on Alibaba.

Growth Potential: With China having the world's largest e-commerce market and a rapidly growing middle class, Alibaba is well-positioned to capitalize on this growth.

Community Feedback

The investment community has varied perspectives on Alibaba. Some express concerns about increased competition, foreign investment restrictions, and Chinese consumer spending. However, others point out the company's strong management, attractive valuation, and potential to tap into the expanding Chinese middle class.

The Verdict

Alibaba, as an investment, presents both risks and rewards. While there are undeniable concerns about regulatory challenges and economic slowdowns, the potential for growth, especially in the Chinese market, is vast. As with any investment, it's crucial to do thorough research, understand the company's business model, and be aware of both the bullish and bearish perspectives before deciding.

What's BABA's True Value?

In determining BABA's valuation, I contend that Free Cash Flow (FCF) is the most appropriate metric, even from a conservative standpoint.

Currently, BABA boasts an $11.53 free cash flow per share (excluding its book value).

First question: Is this sustainable?

I think so.

Let’s assume you want at least a 10% return.

$11.53/10% = $ 115.30/ share . That’s making the big assumption that they stop growing forever. Any growth is your margin of safety. So, this is an unrealistic valuation because it is too conservative.

Shares outstanding?

They are buying back the stock when it’s cheap. That’s even better for us!

So we have established so far is a good buy. What if we take into account growth?

First question: how much has it grown in the past?

Let's simplify our assumptions: we'll project a steady company growth rate of 6% for the first 20 years, followed by 10% for the subsequent 20 years. Based on this, the stock's trading range should be between $158.89 and $224.99.

Diving deeper into a realistic scenario, the current risk-free rate stands at 4.49% for the 10-year bond. If we conservatively maintain the 6% growth for 20 years, the stock value rises to $269/share. Adding the book value, we reach an estimated $307/share. However, this assumes stable interest rates in the future, which might be an optimistic view. But, according to financial theories, this is the approach to stock valuation.

To justify the stock's current price, the company's free cash flow would need to decline by 18.45% over a decade, per the reverse DCF Model. We can term this phenomenon as the "China tax."

Though the projected range is wide, my attention is primarily on the lower limit. I'm confident that the upside potential will emerge over time. It's crucial to highlight the immense market opportunity, especially since the target demographic is quintuple of the U.S. population. However, their average income is 6 to 7 times lower, signifying a vast growth horizon.

Moreover, BABA's present trading metrics indicate a historical trough, especially when evaluating its Enterprise Value to Free Cash Flow ratio.

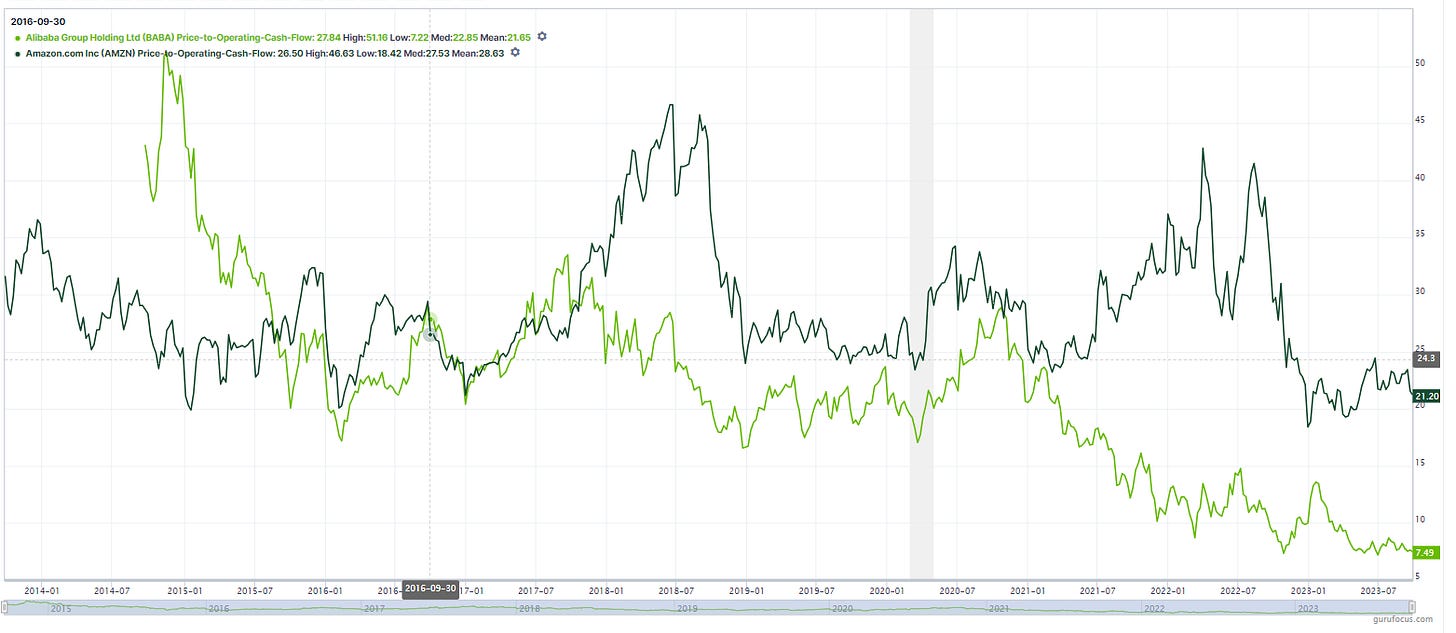

Let's draw a comparison between BABA and its U.S. equivalent, Amazon. It's essential to note that while these two giants have similarities, they are not mirror images of each other. However, if one were to find a U.S. counterpart for BABA 0.00%↑, AMZN 0.00%↑ Amazon would be the closest match. Notably, Amazon typically reinvests a significant portion of its Free Cash Flow. Thus, a more fitting comparison might be their Cash Flow from Operating Activities and their Price-to-Sales (P/S) ratios.

Here's a concise overview:

Amazon's Price-to-Operating-Cash-Flow is 21.92, whereas BABA's stands at 7.57.

Regarding the P/S ratio, Amazon registers at 2.52, while BABA is at 1.76.

However, before you consider BABA 0.00%↑ or any other China stock, consider this:

The bad news in China today

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making any investment decisions.