Borrowing Against Stocks Strategy

The rich don't pay taxes, they borrow against their stock. And so, can you

"By borrowing against your appreciated assets, like stocks, instead of selling them, you can access cash without triggering a taxable event. This allows you to continue holding the stocks, letting them appreciate further while deferring capital gains taxes. As long as the interest rate on the loan is lower than the potential capital gains tax, this strategy can be beneficial for maintaining and growing wealth." -

I was watching this interview, and it reminded me of this strategy. I decided to create a post as a reminder to myself, it would be a reminder to you too.

Excerpt from the Transcript: Scott Galloway explains a strategy used by wealthy individuals to minimize their tax liability by borrowing against their stocks instead of selling them. Here’s a breakdown of what he says:

Borrowing Against Stocks: Instead of selling your stocks when they appreciate, you can borrow against them. For example, if you own $100,000 in Amazon stock and need money, instead of selling the stock and realizing a taxable capital gain, you borrow $50,000 against it. This loan is tax-free, and the stock can continue to grow.

Tax Benefits: By borrowing instead of selling, you avoid triggering a taxable event. The interest on the loan may be lower than the capital gains tax you would have paid if you sold the stock. Over time, as the value of the stock increases, you can borrow more against it without paying taxes on the appreciated value.

Leveraging for Wealth: Wealthy individuals often use this method to maintain their stock holdings while still accessing capital. The stock's value continues to grow, and they avoid paying capital gains taxes until they eventually sell, if they ever do.

One strategy stands out for its effectiveness in minimizing taxes while allowing your investments to continue growing: borrowing against your stocks. This approach, often employed by the wealthy, can be a powerful tool for anyone looking to build and preserve wealth.

What is Borrowing Against Your Stocks?

Borrowing against your stocks involves taking out a loan using your stock portfolio as collateral. Instead of selling your stocks when they increase in value—an action that would trigger capital gains taxes—you borrow against them. This allows you to access the cash you need while avoiding the immediate tax consequences.

For instance, imagine you own $100,000 worth of Amazon stock, and it has doubled in value. Instead of selling the stock and paying taxes on the $50,000 gain, you could borrow $50,000 against it. The stock remains in your portfolio, potentially growing even more, and you can use the borrowed funds without incurring taxes.

How Does It Work?

Assess Your Portfolio: First, evaluate your stock portfolio to determine how much equity you have and how much you might want to borrow. Keep in mind that not all brokerage firms offer the same loan-to-value (LTV) ratios, so the amount you can borrow might vary. While borrowing against your stocks can be a powerful tool, it does come with risks. If the value of your portfolio drops, you may face a margin call, where the broker requires you to deposit more funds or sell off assets to cover the loan. It's crucial to monitor your investments closely and be prepared to act if necessary.

What securities are eligible for margin?

The following securities are eligible to use as collateral for margin borrowing:

Most equities* and ETFs trading over $3 a share

Most mutual funds that have been held for at least 30 days

Treasury, corporate, municipal, and government agency bonds

https://www.fidelity.com/trading/margin-loans/how-it-works

Access Your Funds: After approval, you can access the funds. These loans are typically structured as revolving lines of credit, meaning you can borrow as much as you need, up to your approved limit, and repay it on your schedule.

https://www.interactivebrokers.com/en/trading/margin.php

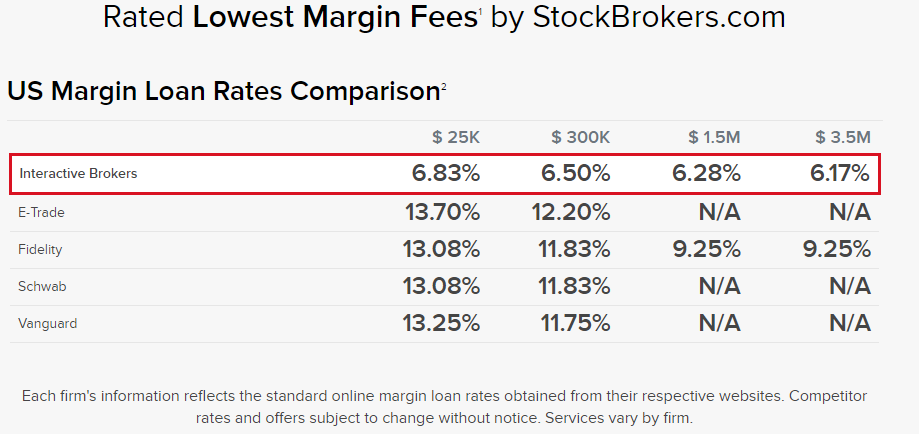

Repayment: You’ll need to make regular payments on the loan, including interest. However, since the loan is secured by your stock holdings, the interest rate is usually lower than that of unsecured loans.

Benefits of Borrowing Against Stocks

Tax Efficiency: The primary benefit is tax avoidance. By borrowing instead of selling, you don’t realize a capital gain, so you don’t pay taxes on the increase in your stock’s value.

Continued Growth: Your stocks remain in your portfolio, allowing them to continue appreciating. Over time, this can significantly increase your wealth compared to selling your stocks and paying taxes on the gains.

Access to Capital: You get the cash you need without having to sell your assets. This can be particularly useful for making large purchases or investments.

Risks to Consider

While borrowing against your stocks can be a smart financial move, it’s not without risks:

Market Risk: If the value of your stocks drops significantly, you may be required to repay the loan or provide additional collateral. This is known as a margin call.

Interest Costs: While interest rates on these loans are typically lower than other types of credit, they can still add up over time. Ensure that you have a plan to manage and repay the loan.

Potential for Over-leverage: It can be tempting to borrow as much as possible, but over-leveraging can lead to financial strain if the market turns against you or if you experience a personal financial setback.

Conclusion

Borrowing against your stocks is a sophisticated strategy that, when used wisely, can help you build wealth while minimizing taxes. As Scott Galloway suggests, it’s a method that many wealthy individuals use to maintain and grow their assets over time. By keeping your investments intact and leveraging them for cash flow, you can enjoy the benefits of your growing portfolio without the immediate tax burden.

However, like any financial strategy, it’s essential to understand the risks and plan accordingly. If done right, borrowing against your stocks can be a powerful tool in your wealth-building arsenal.

resources:

https://investors.interactivebrokers.com/en/accounts/fees/interestCharged_Examples.php

https://www.schwab.com/learn/story/margin-how-does-it-work