Dark illiquid Warrants from $GLASF are trading at $0.95 but should be worth $1.65 according to theoretical value.

Markets are not efficient

Less than a week ago I posted an article talking about a warrant trading a Warrants from $GLASF are trading about 46.05% discount than its calculated theoretical value. (I’ll add the link at the end)

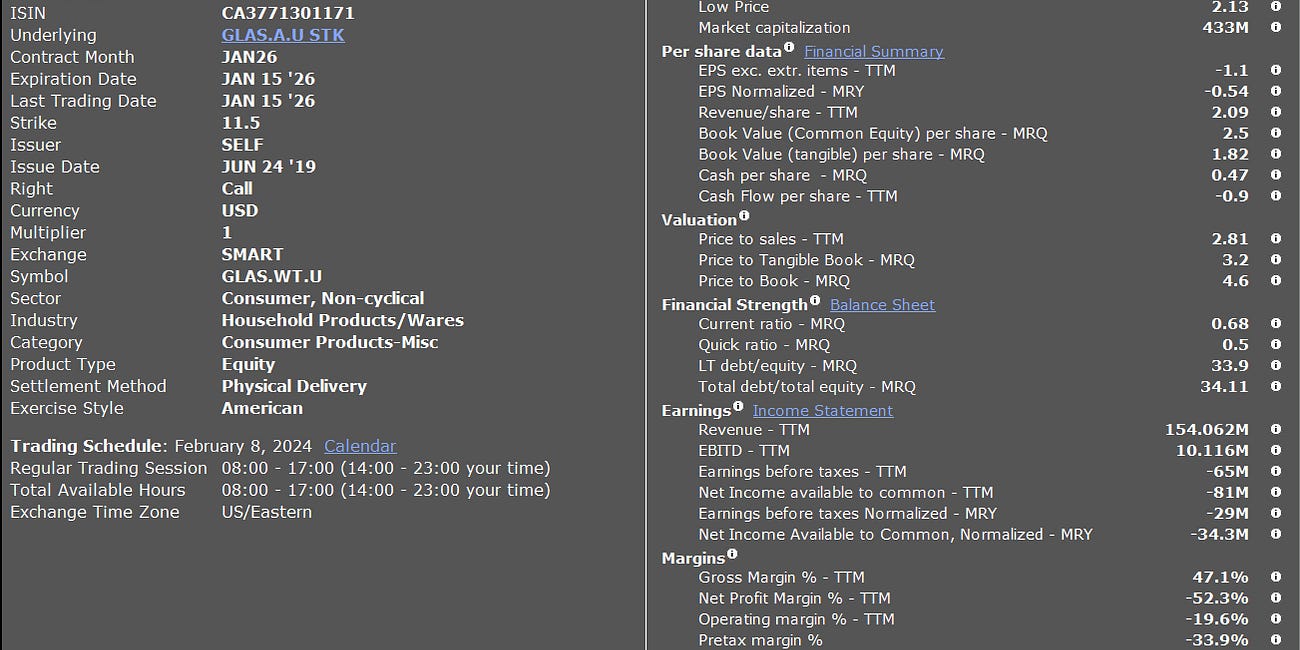

Mr. Aaron Edlheit clarified that the information I got from interactive brokers is wrong. The Warrants don’t have 1.9 years but 2.38.

So let me calculate the value again, today.

The price of the warrant since then has gone up to $0.95

Current Spot Price of the Underlying Asset: $6.75

Strike Price: $11.5

Risk-Free Interest Rate: 4.14%

Volatility: 62.89%

Expiration Date: June 2026

The time to expiration for the warrant, given an expiration date in June 2026, is approximately 2.38 years. Based on the Black-Scholes model and the given parameters, the theoretical value of the warrant is approximately $1.65.

Unveiling Undervaluation: A Financial Analysis of GLASS HOUSE BRANDS INC Warrant

Dark illiquid Warrants from $GLASF are trading about 46.05% lower than its calculated theoretical value. In my quest to uncover undervalued opportunities within the stock market, I've honed in on the GLASS HOUSE BRANDS INC warrant. This American-style warrant, with its allowance for exercise before expiration, presents a unique case of undervaluation tha…