How to Use EDGAR to Navigate SEC Filings: A Comprehensive Guide

Navigating SEC filings can seem daunting, but with the right approach, you can extract valuable information to make informed investment decisions. EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, is the SEC's database of all public company filings. This guide will walk you through the process of effectively using EDGAR to find and analyze company filings.

Step 1: Using the Company Search Feature

The company search feature is your starting point for finding specific filings. You can search by company name or ticker symbol.

Enter Company Name or Ticker: Type the company name or ticker symbol into the search bar. For example, use "LEE" for LEE ENTERPRISES, INC.

Autofill Feature: Take advantage of the updated autofill feature, which now supports a wider range of companies.

Click View Fillings

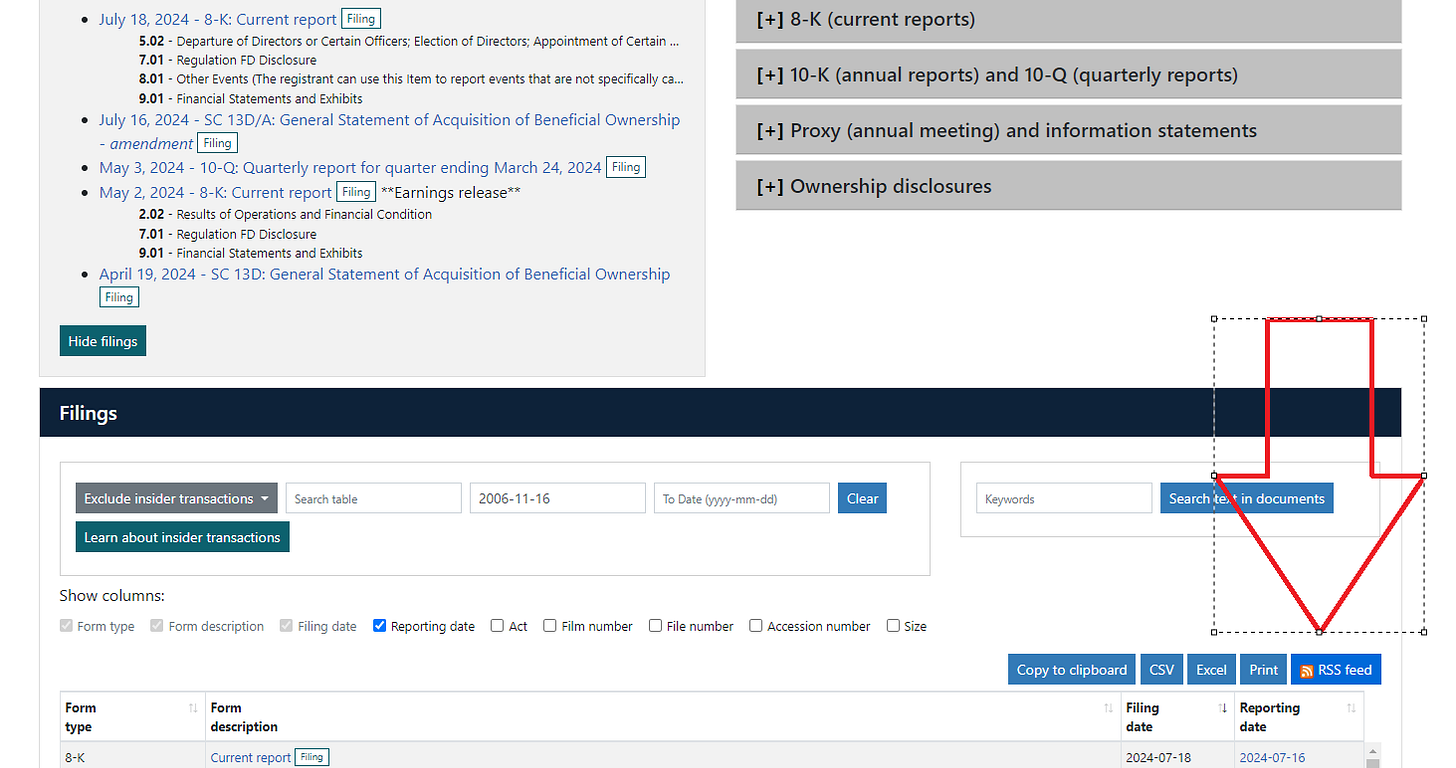

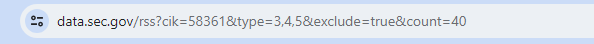

Click on “RSS feed”

Copy the URL

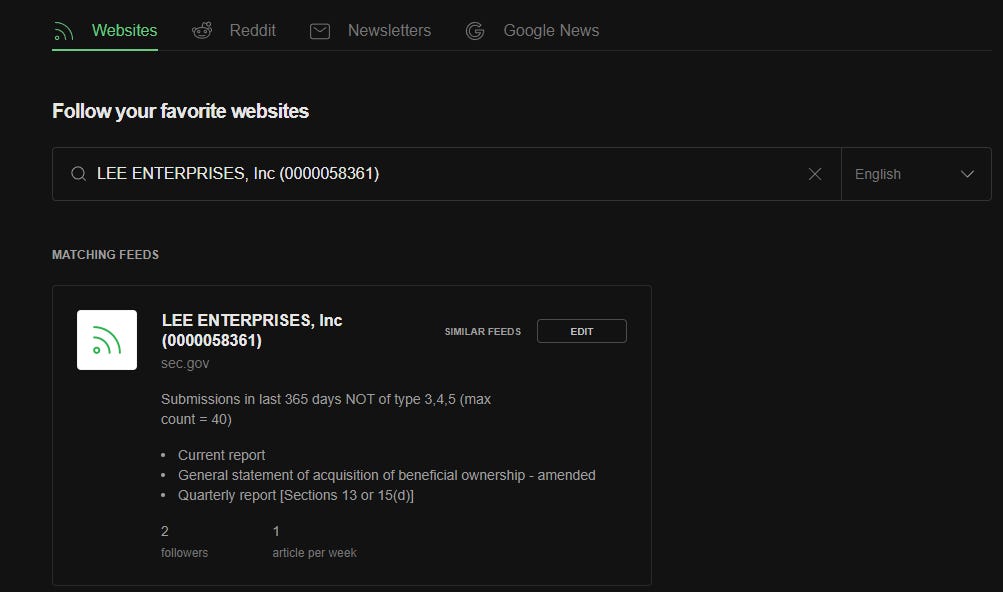

Go to your account in Feedly.com and click on the “follow resources icon”

add it to the search bar

I do check this page daily, so I don’t miss fillings.

Step 2: Viewing and Understanding Filings

Once you find the company, you’ll see a list of filings on the left-hand side. These include annual reports (10-K), quarterly reports (10-Q), current reports (8-K), and various amendments.

Locate Filings: On the company’s page, look at the left-hand side to find the list of filings.

10-K: The annual report that provides a comprehensive overview of the company's financial performance.

10-Q: The quarterly report that updates the financial performance throughout the year.

8-K: Reports significant events that shareholders should know about.

Amendments: Corrections or updates to previous filings.

Step 3: Reviewing Correspondence

The correspondence (CORRESP) section contains communications between the company and the SEC. This can provide insights into regulatory issues or required corrections.

Find CORRESP: Look for entries labeled "CORRESP".

Analyze Content: Read through the correspondence to understand any concerns the SEC has raised and how the company is addressing them.

Step 4: Detailed Analysis and Important Exhibits

Filings often contain detailed financial statements and other important information. Specific exhibits can offer in-depth data that is crucial for thorough analysis.

Identify Key Filings: Look for 10-Ks and 10-Qs for financial data, and 8-Ks for significant events.

Examine Exhibits: Pay attention to exhibits like 99.1, which often contains detailed financial statements.

Amendments: Note any amendments to understand why corrections were made.

Step 5: Analyzing Financial Statements

Understanding the financial health of a company requires a deep dive into its financial statements.

Income Statement: Look at revenue, expenses, and net income to assess profitability.

Balance Sheet: Examine assets, liabilities, and shareholders’ equity to understand the company’s financial position.

Cash Flow Statement: Review cash inflows and outflows to evaluate liquidity and cash management.

Step 6: Investigating Corporate Governance

Proxy statements (DEF 14A) provide insights into corporate governance, including information on executive compensation, board members, and shareholder voting.

Find Proxy Statements: Look for DEF 14A filings.

Executive Compensation: Analyze how executives are compensated to understand incentives.

Board Composition: Review the board’s composition to assess its effectiveness in overseeing the company.

Step 7: Using Background to the Deal for M&A Analysis

For mergers and acquisitions, the background section of the filing provides detailed information on the deal.

Identify Relevant Filings: Look for 14A filings related to mergers and acquisitions.

Read Background Section: Understand the timeline, negotiations, and rationale behind the deal.

Fairness Opinions: Examine fairness opinions to see how the deal was valued and justified.

Step 8: Tracking Insider Transactions

Form 4 filings disclose insider transactions, providing insight into the buying and selling activities of company executives and directors.

Locate Form 4 Filings: Search for Form 4 to see recent insider transactions.

Analyze Transactions: Look at the volume and timing of insider transactions to gauge their confidence in the company’s future.

Step 9: Utilizing Additional Tools and Resources

Leverage additional tools and resources to enhance your analysis.

OTC Markets: For stocks not listed on major exchanges, use OTC Markets to find information.

Financial Websites: Use sites like QuickFS and Morningstar for supplementary data and analysis.

RSS Feeds: To ensure you don’t miss any filings, look for the RSS feed on EDGAR and add it to your Feedly.com account, which you should review daily.

Conclusion

By following these steps, you can effectively navigate the SEC EDGAR database to find and analyze company filings. This process will equip you with the detailed information needed to make informed investment decisions. Stay diligent and use the wealth of data available through EDGAR to your advantage. Happy investing!