How much is OROCO Resources worth? $OCO, $

Summary

In this article, you will see

The comparable projects, the historicals, the 4 methods of valuations updated to the minute with copper prices in my spreadsheets.

Explanations of why we use those 4 methods and where they came from

Sources of each piece of information

All of this so you have no doubt in your mind of the rationale behind this valuation models.

Here is a reminder of the initial post on OROCO

What I’m going to do here is to show you step-by-step the calculations to determine the value of the stock.

But first a reminder of the four methods from that article:

Valuation

I'll walk you through my calculations of why Oroco's stock is at least 300% to 1000% from today's prices, even if copper prices don't go up.

Keep in mind that the mine is in low elevation with excellent infrastructure, close to a port in a friendly mining sector. This translates to low capital expenditures for development.

There are four ways to value the project

1. Comparables

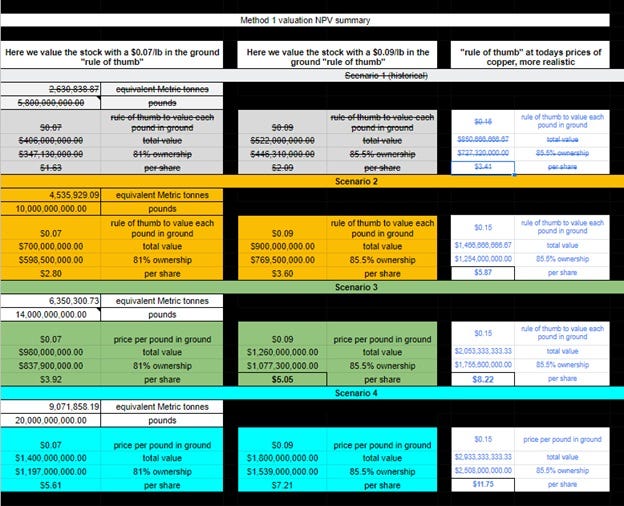

Historical averages paid for copper in the ground. An average of $0.07 to $0.09 contained metal per pound when the price of copper was around $3. However, the price of copper today is higher, and this average should be around $0.15 with today's price of $4.40.

We base the projections on a couple of companies that take historical transactions and use those parameters, like Ambrian and RBC Capital.

The reason "scenario 1" is strikethrough is because we already passed this pound assumption, so we are on our way to Scenario 2 or higher. And the price per share you want to keep an eye on here is in blue.

2. Internal rate of return IRR%

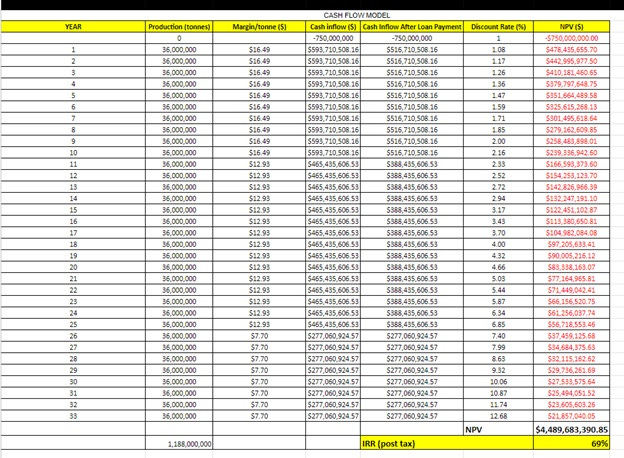

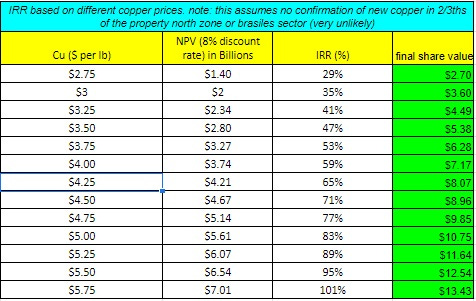

Reverse engineer return. This is the hardest one because we don't know the project's costs yet or its Leverage to calculate an internal rate of return IRR. Here is where my finance degree came in handy. The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. When a "Major" comes to buy Oroco, they will be using this metric at the end. I heard anything over 20% is good. Historically

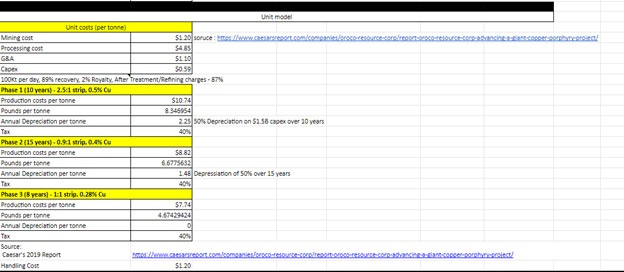

Assumptions:

Cash flows for the next 33 years of production:

Basically, this says that if you are a developer and your minimum cost of capital is 8%, you would make a 69% rate of return on this project.

But what if the price of copper moves?

Notice these calculations are being done without taking into account 2/3ths of the property!

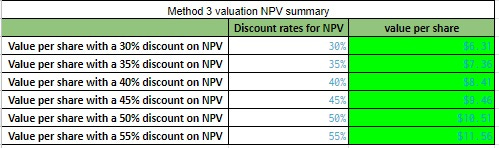

3. Valuation method Net Asset Value (NPV)

Here we took the expected cash flows and discounted them to present value.

The present value of the cash flows at your project's required rate of return compared to your initial investment. Ambrian has also said that projects trade at between 35 and 55% of NPV. And NPV is very much driven by grade and copper price along with CAPEX. At Santa Tomas (the one property we are analyzing), we'll have a relatively low CAPEX because of the location and a high copper price. In the core, we have a good grade.

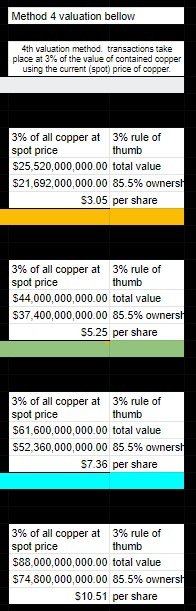

4. Historical rule of thumb on asset value

Historical comparable transactions have taken place at 3% of the value of contained Copper using Copper's current (spot) price.

Now the spreadsheets with explanations of every detail.

Please open this spreadsheet with. I’ll start explaining every calculation. Remember all valuations updated to the minute with copper prices:

Keep reading with a 7-day free trial

Subscribe to Start with the A's to keep reading this post and get 7 days of free access to the full post archives.