How to Read a 10-K Like a Professional Investor

Understanding how to read and analyze a 10-K report is essential for making informed investment decisions. As a comprehensive summary of a company’s financial performance and strategy, the 10-K provides crucial insights. In this post, we’ll break down the components of the 10-K that are most revealing and guide you through the process of analyzing this vital document step-by-step.

1. Starting with the CEO or Chairman’s Letter

The CEO or chairman’s letter is a great place to begin. This section often provides a narrative of the company's performance, future outlook, and strategic direction. Reading these letters over several years can offer valuable insights into the consistency and reliability of the management team.

Trends to Look For:

Are the stated strategies consistent over the years?

Has the management successfully implemented these strategies?

Are there admissions of shortfalls or challenges?

2. Management Discussion and Analysis (MD&A)

The MD&A section is where the company discusses its financial condition and results of operations. This section helps you understand how the business operates, its financial health, and the key risks it faces.

Key Areas to Focus On:

Financial requirements and risk exposures.

Changes in revenue and expenses.

Analysis of cash flow and capital expenditures.

3. Becoming an Expert on Footnotes

Footnotes are where companies disclose detailed information about their financial statements. This often includes the terms, structure, and components of debt, off-balance sheet liabilities, and more.

Important Footnotes:

Debt details: Look at terms, structure, and maturity.

Off-balance sheet items: Include operating leases and legal liabilities.

M&A earn-outs: Future payments guaranteed to previous owners based on sales targets.

4. The “Risk Factors” Section

This section outlines the potential risks that the company faces. While some risks are standard, look for unique risks related to client concentration or reliance on a specific product.

Examples of Risks:

Dependence on key customers or suppliers.

Regulatory risks.

Market competition and technological changes.

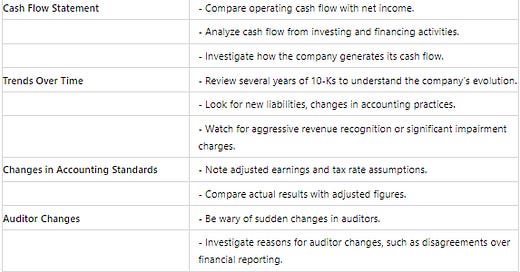

5. Cash Flow Statement

The cash flow statement is crucial as it shows the actual cash generated and used by the company. Unlike revenue, which can be influenced by accounting practices, cash flow provides a clearer picture of financial health.

Key Indicators:

Operating cash flow vs. net income.

Cash flow from investing activities.

Financing activities and borrowing trends.

6. Trends Over Time

To get a complete picture of the company’s evolution, analyze several years of 10-Ks. Look for significant changes in financial practices, new liabilities, or other notable shifts.

What to Track:

New environmental or legal liabilities.

Changes in accounting practices.

Aggressive revenue recognition or significant impairment charges.

7. Changes in Accounting Standards

Companies sometimes adjust their reported earnings based on changes in accounting standards. These adjustments can provide insights into the company’s true financial performance.

Adjustments to Consider:

Tax rate assumptions.

Earnings re-reported and adjusted.

Actual results vs. adjusted figures.

8. Auditor Changes

A change in auditors can be a significant warning sign. It may indicate disagreements over financial reporting.

Warning Flags:

Sudden changes in auditors.

Disagreements over financial figures.

Historical context of auditor changes.

9. Proxy Statement

The proxy statement, filed before the annual shareholder meeting, includes important information about executive compensation, governance, and shareholder voting matters.

Why It Matters:

Provides insights into management incentives.

Reveals governance practices.

Helps in understanding shareholder rights and proposals.

Conclusion

Reading and analyzing a 10-K report like a professional investor involves more than just skimming through the numbers. It requires a deep dive into various sections to understand the company's operations, risks, and financial health. By following these steps, you can gain a comprehensive understanding of a company's true performance and make more informed investment decisions.