Jerash Holdings: A Graham and Early Buffett-Style Value Buy - Navigating the Global Apparel Market with Strategic Partnerships

Pay for the cash in the bank, the business comes for free.

I wanted to post about this company before I forgot again. A couple of weeks ago, I was traveling through the Netherlands, and somehow I mixed this write-up with another net-net, JCTCF- Jewett-Cameron. Sorry about that!

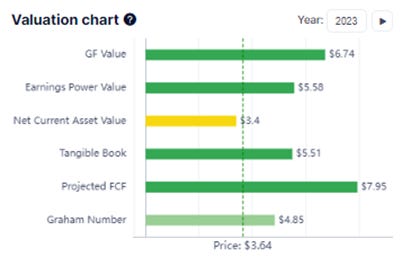

In a quick summary, this is an incredibly cheap stock. It definitely has the potential to grow in the years to come. However, it has the “danger” that 60% of its income comes from one client. I won’t spoil the hunt for you, so I’ll leave it there. Here is a little intro to see if you would be interested in pursuing it.

Jerash Holdings (US) Inc - NAS: JRSH

Jerash Holdings (US) Inc. and its subsidiaries manufacture and export customized, ready-made sport and outerwear from knitted fabric from its production facilities in Jordan. The company manufactures for retailers, namely Walmart, Costco, Sears, Hanes, Columbia, Land's End, VF Corporation, and Philip-Van Heusen, which owns brands such as The North Face, Nautica, Timberland, Wrangler, Lee, Jansport, Calvin Klein, Tommy Hilfiger, IZOD, Speedo, etc.

It derives its revenue from the manufacturing and sales of outerwear in the United States. The company's product offerings include jackets, polo shirts, crewneck shirts, pants, and shorts made from knit fabric.

The company's production facilities comprise six factories and five warehouses, employing approximately 5,000 people. The total annual capacity at the facilities was approximately 14 million pieces as of March 31, 2023.

Jerash collaborates with prominent global brands, including The North Face, Timberland, New Balance, American Eagle, Calvin Klein, and Adidas. These partnerships emphasize the company's dedication to delivering high-quality products while maintaining ethical standards.

The company has been subject to a corporate income tax rate of 19% or 20% plus a 1% social contribution since January 1, 2023.

Look at these financials! It looks good for a small company trading at less than cash in the bank. Raising sales with positive EBITDA and Net income every year. Plenty of cash in the bank. Cash flowing and paying dividends.

What’s not to like? The return on invested capital keeps decreasing, which is not necessarily bad unless they plan to keep and reinvest the money.

Despite the challenging economic environment marked by inflation fears and a potential recession, it has successfully onboarded new customers such as Hugo Boss, Timberland and doubled its volume with G-III. To adapt to the changing market, the company has adopted a strategy of taking on lower-margin but high-volume business, ensuring that its workforce remains engaged. This approach distinguishes Jerash Holdings from competitors who have resorted to layoffs or closures.

While risks are associated with doing business in Jordan, such as regional unrest and higher levels of corruption compared to the US.

Looking to the future, Jerash Holdings plans to expand its capacity and is exploring bank financing options. The timing of this expansion will depend on the business generated through its joint venture with Busana, one of the largest apparel companies in Indonesia. The company aims to leverage the duty-free or free trade agreement shipping out of Jordan to the US and Europe by offering higher-priced, higher-value products.

My opinion:

1. Seasonality of Sales and concentration risk with VF Corporation.

2. Results of Operations: In fiscal 2023, the company's revenue decreased by 4% to $138.1 million from $143.4 million in fiscal 2022. This decrease was mainly due to a decline in export sales to two major U.S. customers. Despite new customers and increased shipments to existing customers, these efforts were insufficient to offset the sales shortfall.

3. Liquidity and Capital Resources: As of March 31, 2023, the company's cash balance was approximately $17.8 million, and restricted cash was approximately $1.6 million. The decrease in total cash was primarily due to acquisitions, the construction of a new dormitory building and the extension of a factory building, dividend distribution, and a share repurchase program.

4. Capital Expenditures: The company had capital expenditures of approximately $13.8 million and $8.7 million in fiscal 2023 and 2022, respectively. These expenditures included investments in additional plant and machinery, the construction of a dormitory and factory expansion, and acquisitions.

5. Future Projections: The company projects capital expenditures of approximately $2.6 million and $8.5 million in the fiscal years ending March 31, 2024, and 2025, respectively, to enhance production capacity further to meet future sales growth. I can easily see them getting into trouble with these goals.

6. Their real estate portfolio may be very hard to liquidate. Even with that, the stock is cheap.

Notes:

· The first factory, owned by the company, employs around 1,400 people and houses management offices, production lines, a trim warehouse, and units for printing, sewing, ironing, and packaging. The second factory, leased by the company, also employs around 1,400 people and houses administrative and human resources personnel, merchandising and accounting departments, embroidery, printing, additional production lines, trims, finished product warehouses, units for sewing, ironing, packing, and quality control. The third factory, also leased, employs around 200 people and is primarily used for cutting products. The fourth and fifth factories, under Paramount and MK Garments, respectively, house additional production lines and manufacture garments for customer orders.

· The production facility in Al-Hasa County comprises a factory that employs around 300 people and manufactures garment products per customer orders. This factory was a joint project with the Jordanian Ministry of Labor and the Jordanian Education and Training Department, and has been used rent-free since its construction in 2018.

· In 2015, the company started a project to build a 4,800 square-foot workshop in the Tafilah Governorate of Jordan, which is now used as a dormitory for management and supervisory staff. In April 2021, construction began on a 189,000 square-foot housing facility for the multinational workforce in Al Tajamouat Industrial City. The company also plans to construct an additional project on a nearby 133,000 square-foot parcel purchased in 2019, with two-thirds of the land allocated for a seventh factory and one-third for housing.

· As of March 31, 2023, the total annual capacity at the existing facilities was approximately 14 million pieces. The production flow begins in the cutting department, then moves to the embroidery department if applicable, followed by the sewing unit, finishing department, quality control, and finally the ironing and packing units. The company does not have long-term supply contracts or arrangements with its suppliers and purchases raw materials such as fabric, zippers, and labels on a purchase order basis, with most suppliers designated by customers.