Oroco Resources

3x to 10X from here

Summary

My highest stock conviction, is at least 300% to 1000% from today's prices, even if copper prices don't go up.

This stock offers a leverage play on copper without any debt. For every $0.01 that copper goes up, this company’s value goes up to $0.04.

I think copper will continue to go up due to the electrification of things and the huge effort of humanity to go green.

Oroco's thesis resembles a "Special Situations or "Workouts" More than a normal junior mining stock

4 Ways to value OROCO

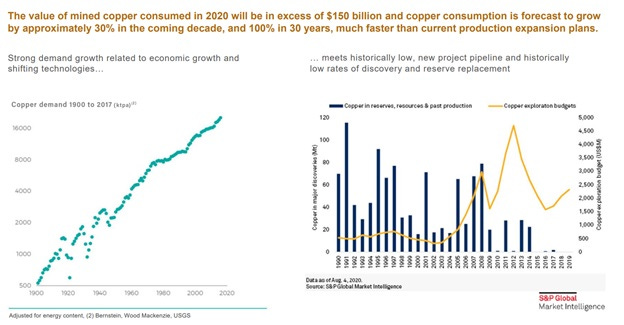

Why copper?

Goldman Sachs has also declared copper "the new oil," expecting copper to set an all-time high in 2022. - PRNewswire

Very simply, there's a lot more demand and not enough production in years to come.

The growing demand for green energy can drive up copper prices in the future since this metal is utilized in electric cars, solar energy, and wind energy, among other applications.

There have been few major cooper discoveries in the last ten years.

After gold and silver, copper is the third most popular metal for investors. It does better in periods of inflation and economic turmoil.

Copper is the backbone of future food security, infrastructural development, CO2 reduction, and sustainable development.

Due to copper's flexibility and relevance to a wide variety of sectors, the world economy consumes a growing quantity of metal. While recycling used copper helps fulfill around 30 percent of global demand, rising use necessitates the continual development of new copper resources.

If you want to make electric vehicles, you need 400% more copper per car.

We will need 250% more copper by 2030.

"The electric vehicles industry currently makes up just 1% of copper demand. By 2030, many analysts expect that figure to reach 10%,"

The problem is that there are no easy places to access copper. To put a new mine, into production, it will take an average of 7 years.

If you still need to learn more about the economics of copper, click here

Oroco (TSX-V: OCO.V) (OTCQB: ORRCF) is deeply undervalued and a high certainty bet.

What is the best risk-reward, high certainty play in copper that I have found out there?

https://www.orocoresourcecorp.com/

Oroco is a special situation. Because we already know that there is more copper in the property to justify a stock price 100% higher than today.

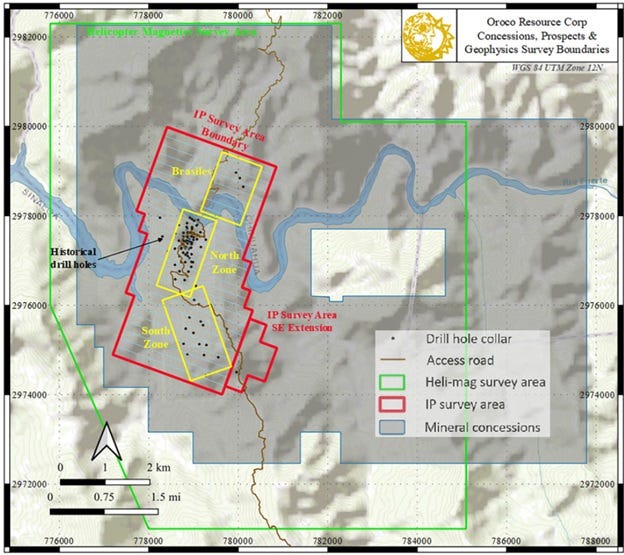

There have been over 100 holes in the past decades to extract samples from the ground and figure if there is copper or not. I’ll call these holes “historicals” from now on.

As you may imagine, these samples don't go bad; they don't change their composition just because you took them out. It is not like milk, which you can take out and after some time is useless. However, the law dictates that they are useless when these samples are old enough.

And then you have to make those holes again if you want to sell the property. This makes sense because samples without supervision can be manipulated.

Why are you seeing this opportunity?

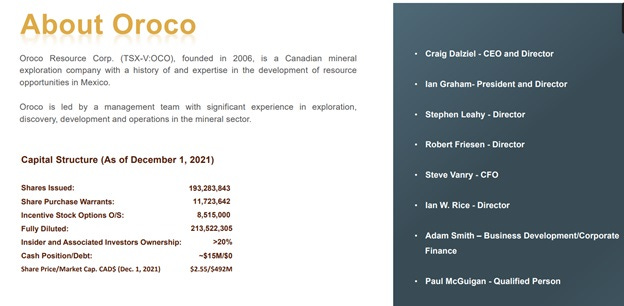

Oroco came out of a 20-year lawsuit, two years ago, and they have been raising money to make the holes again in order to sell the property to be produced to a bigger miner, we call this “Majors”.

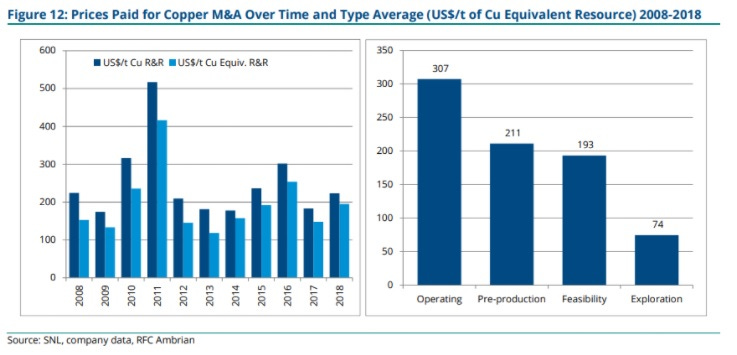

Normally these small miners that are finding resources are called “exploration” miners, and as you can see here they get paid less for every pound of copper equivalent.

They are also considered risky because you can’t tell how much of a resource you have underground until you make perforations, those are really expensive and have a low success rate.

But! we have the historical drillings as a reference in the case of OROCO because even though they are exploring more parts of the property, we already know there is a viable project. It was only frozen in time due to the lawsuit.

What are the common objections when thinking about investing in mining:

1) Is there anything there? How do you know?

2) Will you make money? How much do you need to spend to extract it?

3) Will the community let you start a mine there?

4) Is the country mining-friendly?

Let me answer those questions

1) Yes. I'll show you below under calculations

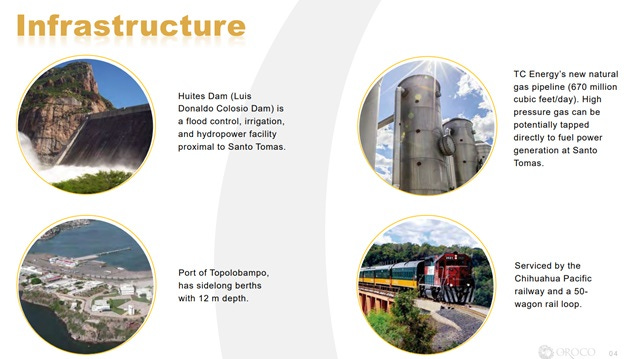

2) This mine is not deep, so you don't have to spend billions to access the copper; you have access to roads, an electric dam nearby, and rivers for mobilization. It doesn't get better than this. Compare it to the other two biggest copper producers in the world, Peru and Chile. Peru is socializing mines, and Chile is now asking miners to desalinate water, which is very expensive.

3) Oroco management has been working with the community for years, and they are excited for all the job opportunities that the mine will create

4) 5th most friendly country for mining in the world

We know that there is a lot more copper there, the market doesn't care until we make the holes again, and that's exactly happening right now. You have to buy the stock, at today’s prices, and wait 18 months to 36 months.

They already have the permits, and they already have the financing. I'd been following management for over two years, and they do what they say and say what they do. I think they are a great team.

But wait, there's more!

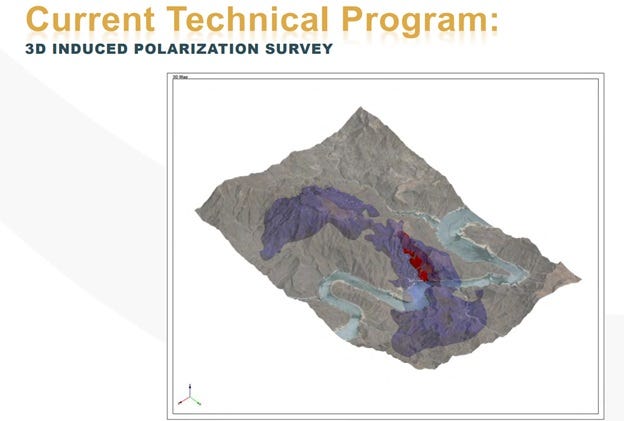

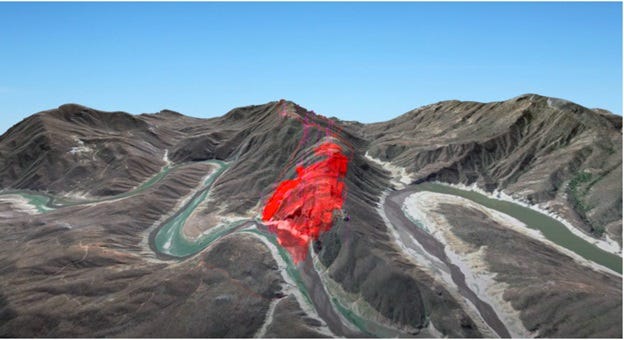

What happened is that last year, management used a new technique to find metals that allow you to scan below the earth. Guess what they found? Everything that is in purple in the image. For our conservative calculations we are only using the red area, don’t forget that.

The purple area just shows mineralization. We don't know the concentrations are high or low but guess how much Mr. Market says it's worth until we have made all the holes… $0. This is obviously crazy!

Oroco is being valued as an exploration company, even though we already know there's a lot of copper there. And as an exploration company, every pound of copper they show is sold at a deep discount, but after they have done all those perforations, they will be upgraded, and those pounds of copper will be more valuable.

If you made it so far… here is another gift:

The area we have been talking about is the area within the red line. I will argue that just here, the stock should be worth CAD $5 to CAD $20. But Oroco has the right to explore everything in gray. And so far, we will give all of this area a value of $0 to be conservative. Isn't that nice?

Team

You can find the team here

https://www.orocoresourcecorp.com/company/directors-officers-team/

Why I see Oroco as Special Situations or "Workouts."

The term Special Situation traces back to Ben Graham, the dean of wall Street and Warrens Buffett professor. This is mentioned, as a subsection, in chapter 15 of his book Intelligent Investor. Investor Joel Greenblatt and Mary Buffett have also popularized it as a situation.

Perhaps an explanation of the term "workout" is in order. A workout is an investment which is dependent on a specific corporate action for its profit rather than a general advance in the price of the stock as in the case of undervalued situations. Workouts come about through: sales, mergers, liquidations, tenders, etc. In each case, the risk is that something will upset the applecart and cause the abandonment of the planned action, not that the economic picture will deteriorate and stocks decline generally. – Buffett 1957

Management has raised money to bring the holes up to date so that a “Major’s” can buy them.

We don't need for the deposit to get bigger to see great gains in the stock price, but we want it to get bigger; of course.

They don't have to research and develop new products; they don't have to compete with technological breakthroughs on their market. They don't have to worry about the inventory going bad. Viruses like Covid slows everyone but don’t change our business model here. The copper is in the ground waiting.

In a market where copper is more scarce every day, the longer the Oroco team takes to close a sale, the higher the price should be due to copper demand and inflation.

Risks and comments on risk

Mexico nationalizes the mining industry:

As mentioned in the bigging, Mexico ranks in the top 5 friendlies country to be a miner.

Environmental:

Compared with other similar projects like Solaris ticker $SLS that is literally in the jungles of Ecuador, Oroco is in the middle of the desert!. Sure, that's an ecosystem too, but orders of magnitude less difficult to manage than the competition.

Raising money

In its current situation, management could raise money easily if they need it.

Permits

They already have a lot of them but not all of them. So far, that hasn't been a problem.

Copper prices

I already talked about the trends at the start. Keep in mind that for Santa Tomas to be a viable project, Copper needs to be $2.75 per pound.

Valuation

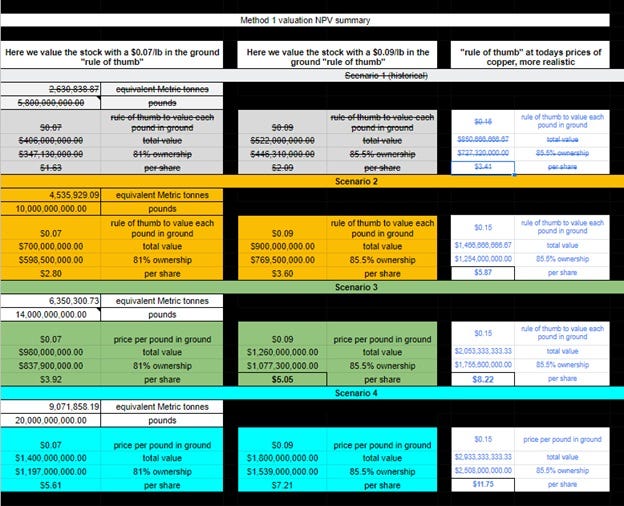

I'll walk you through my calculations of why Oroco's stock is at least 300% to 1000% from today's prices, even if copper prices don't go up.

Keep in mind that the mine is in low elevation with excellent infrastructure, close to a port in a friendly mining sector. This translates to low capital expenditures for development.

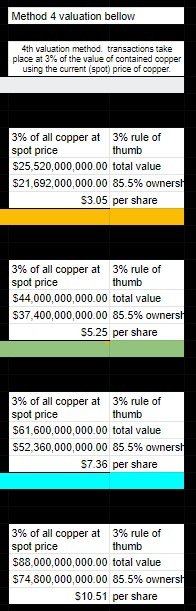

There are four ways to value the project

1. Comparables

Historical averages paid for copper in the ground. An average of $0.07 to $0.09 contained metal per pound when the price of copper was around $3. However, the price of copper today is higher, and this average should be around $0.15 with today's price of $4.40.

We base the projections on a couple of companies that take historical transactions and use those parameters, like Ambrian and RBC Capital.

The reason "scenario 1" is strikethrough is because we already passed this pound assumption, so we are on our way to Scenario 2 or higher. And the price per share you want to keep an eye on here is in blue.

2. Internal rate of return IRR%

Reverse engineer return. This is the hardest one because we don't know the project's costs yet or its Leverage to calculate an internal rate of return IRR. Here is where my finance degree came in handy. The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. When a "Major" comes to buy Oroco, they will be using this metric at the end. I heard anything over 20% is good. Historically

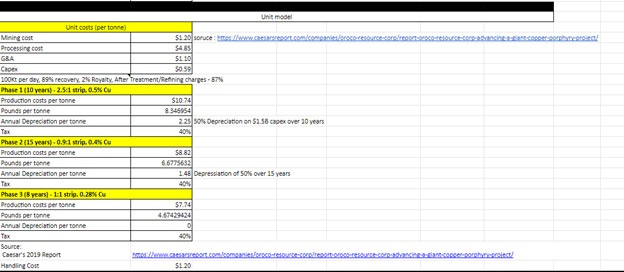

Assumptions:

Cash flows for the next 33 years of production:

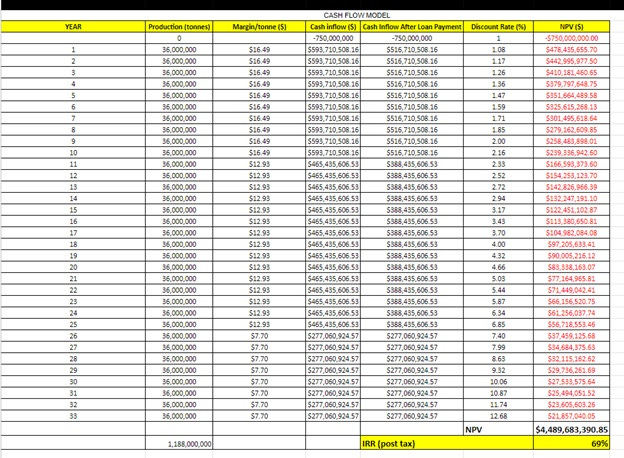

Basically, this says that if you are a developer and your minimum cost of capital is 8%, you would make a 69% rate of return on this project.

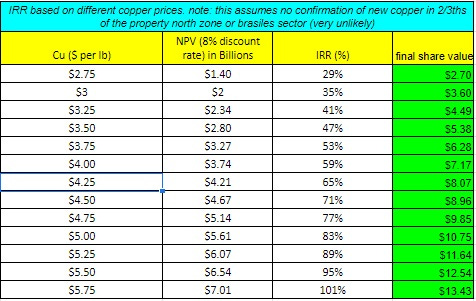

But what if the price of copper moves?

Notice these calculations are being done without taking into account 2/3ths of the property!

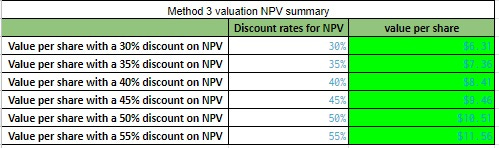

3. Valuation method Net Asset Value (NPV)

Here we took the expected cash flows and discounted them to present value.

The present value of the cash flows at your project's required rate of return compared to your initial investment. Ambrian has also said that projects trade at between 35 and 55% of NPV. And NPV is very much driven by grade and copper price along with CAPEX. At Santa Tomas (the one property we are analyzing), we'll have a relatively low CAPEX, at least of $1.5 Billion, because of the location and a high copper price. In the core, we have a good grade.

4. Historical rule of thumb on asset value

Historical comparable transactions have taken place at 3% of the value of contained Copper using Copper's current (spot) price.

A final note on Leverage

It is no secret that miners are a leveraged play on copper.

Oroco offers operational leverage play on copper without any debt. For every $0.01 that copper goes up, Oroco's net present value goes up to $0.04. This means that if you think copper will go up, this is the way to play it.

Conclusion

I’ll be adding all the spread sheets and calculations for the paid subscriptors

Here we review why Oroco, ticker symbol $OCO, is a high certainty situation—currently trading at CAD $2.2 per share. We can easily argue that it is worth over $5 right now.

But with current drilling on the property for the next 18 months is a virtual certainty that the stock price will trade beyond that without a problem. With a likely range between CAD $8 to CAD $11. And an optimistic price range over CAD $20/share. All of this in a very defined time frame of a couple of years.

Did you enjoy this write-up? Find more details at

and follow me for more.