Private placements a real life example of The return on Day 1 of approximately 21.47%

Theres an update of what actually happened with the Private placement in this exercise at the end of the post

Private placements are a way for investors to invest directly in a company at a discounted price and often come with additional benefits, such as warrants for purchasing more shares at a later time.

Private placements can provide higher returns compared to buying shares on the open market because the capital directly helps accelerate the company's growth, leading to increased share value.

“The rich have access to investment opportunities that others don’t. These opportunities are usually not found on Wall Street and are typically only available to accredited investors or those with the right connections. ... In private placements, the key is to look for opportunities where the risks are clearly understood, and the rewards justify those risks. Education and due diligence are crucial before diving into these types of investments.” - Kiyosaki

Imagine having access to exclusive investment opportunities that the wealthy and well-connected use to multiply their wealth—deals that aren't available to the general public. These high-return, high-risk investments, known as private placements, could be your ticket to extraordinary financial growth. But here's the catch: private placements aren't something you stumble upon by accident. They're part of a hidden world, one where strategic knowledge and networking are your keys to success. If you're ready to step into this world, unlock the potential of private placements, and learn how to make investments that could change your financial future, keep reading—this is your chance to get ahead of the curve.

Definition: Private placements involve investing directly in a company's securities (stocks or bonds) before they are made available to the public, often with the inclusion of additional incentives like warrants.

Investment Opportunity: Private placements allow investors to purchase shares at a discounted price, typically accompanied by warrants, which are options to buy more shares at a later date, providing potential for significant profits.

Risk and Reward: These investments can offer high returns, especially when a company’s value grows post-placement. However, they also come with the risk of limited liquidity and the potential for losses if the company fails to perform.

Access and Availability: Private placements are typically offered to accredited investors or through specific platforms, like Stockhouse’s "deal room," which lists current private placement opportunities.

Long-Term Strategy: Successful private placement investing requires thorough research, belief in the company's long-term potential, and a disciplined approach to holding the investment until it reaches its full potential, even during market volatility.

Private placements are a world of investment opportunities typically reserved for the wealthy and well-connected, but what if you could gain access to these high-return deals? In this post, we’ll explore what private placements are, why they offer exceptional investment potential, and how you can position yourself to take advantage of these exclusive opportunities.

What Are Private Placements?

A private placement is a method of raising capital for a company or project by offering securities (such as stocks or bonds) directly to a select group of accredited investors, rather than through a public offering. These investors could include institutional investors, wealthy individuals, or venture capitalists who meet specific financial criteria set by regulatory bodies. Because private placements are not offered to the general public, they are not subject to the same stringent regulatory requirements as public offerings, making them a quicker and more flexible option for companies looking to raise funds.

Private placements offer the potential for higher returns compared to traditional investments, but they also come with increased risk and less liquidity, as these investments are often harder to sell or trade.

Example of a Private Placement:

Imagine a startup company in the tech industry is looking to expand but needs additional capital. Instead of going through a public offering or crowdfunding, the company opts for a private placement. They reach out to a select group of institutional investors and high-net-worth individuals, offering them shares of the company at a discounted price before it goes public.

In this case, the investors who participate in the private placement could potentially benefit if the company grows and later goes public, offering a significant return on their initial investment. For example, investors might buy shares at $1 each, and when the company eventually IPOs, those shares could be worth $10 each, making the investment highly profitable.

This method of raising funds allows the company to grow without the complexities and costs associated with a public offering, while providing private investors the opportunity to get in early on a potentially lucrative venture.

Why Should You Care About Private Placements?

1. Exclusive Investment Opportunities

Private placements are typically not available on the open market, which means they are exclusive opportunities for accredited investors. Getting involved in these investments early can allow you to benefit from company growth or project success before they become public, offering returns that far exceed traditional stock investments.

2. A Different Kind of Risk

Unlike public markets, private placements come with a different set of risks. These investments are less liquid and often come with less oversight, but they can also offer significant rewards. The key is understanding the risks and being prepared to make educated decisions based on solid research.

By learning how to evaluate these deals, you can mitigate risks while still taking advantage of the high-return potential that private placements provide.

3. Access to Early-Stage Ventures

One of the most attractive aspects of private placements is the chance to invest in early-stage companies or projects that haven’t yet gone public. This can give you a unique opportunity to get in on the ground floor of companies that have strong growth potential. While these investments can be risky, the upside is substantial if the company or project succeeds.

4. Building Strong Investment Networks

Private placements often come with the benefit of exclusive access to a network of like-minded investors and entrepreneurs. These networks can provide valuable insight into future investment opportunities and help you identify deals that might not be publicly available.

Building relationships with other investors and decision-makers in this space can be key to accessing the best deals and maximizing your potential for success.

The Importance of Getting Involved Early

Private placements allow you to invest in companies before they go public or before a major financial event, such as an IPO. By getting involved early, you can take advantage of lower entry points, which often lead to higher returns once the company or project gains traction.

For example, early investors in successful private placements often see their investment grow significantly when the company eventually goes public or experiences a significant financial event. Getting in at the right time can make all the difference.

Private placements are a unique and powerful investment strategy that can offer high returns, but they require a solid understanding of the market, a network of connections, and a willingness to take on some risk. By positioning yourself to access these opportunities, you can unlock substantial wealth-building potential.

If you're serious about expanding your investment strategy and exploring private placements, now is the time to start learning, building relationships, and making educated investment choices. The world of private placements may seem exclusive, but with the right approach, you can find your way in and start profiting from these hidden gems.

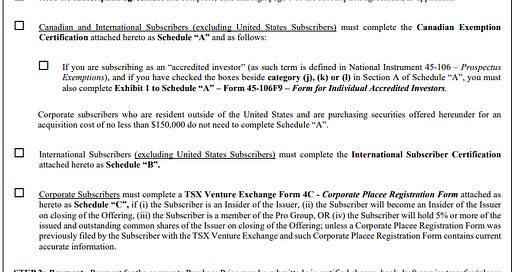

Here’s a detailed explanation alongside the specific terms of the Private Placement Subscription Agreement for Oroco Resource Corp.:

1. Offering Terms

Price per Unit: The Units are priced at $0.30 per Unit. This is the cost at which investors can purchase a unit, and each unit consists of shares and warrants.

Unit Composition: Each Unit consists of:

One common share in Oroco Resource Corp. (currently $0.32/share)

Half a common share purchase warrant.

This means that for each Unit purchased, the investor receives one share and a warrant that gives them the option to buy an additional share at a set price.

Explanation: A warrant is essentially a “coupon” allowing the investor to buy more shares at a specified price in the future, which could be advantageous if the company’s share price rises. The fact that the Unit price is $0.30 per share makes this an attractive deal, particularly for investors who believe the company’s shares will appreciate.

The return on Day 1 is approximately 21.47%, assuming no immediate change in the stock price but taking into account the value of the warrant. This represents an unrealized gain based on the warrant's potential value on Day 1.

If the stock price moves higher, the return would increase significantly due to the leverage provided by the warrants. However, if the stock price falls, the return could decrease, and the warrant may lose value.

Economics of the Private Placement

The private placement in Oroco Resource Corp. offers investors a combination of common shares and warrants, which creates a flexible investment structure. Let’s break down the key components and how they contribute to the economics of this deal.

1. Common Shares

The common shares represent the core investment in Oroco Resource Corp.. When you purchase a Unit, you are buying stock in the company, which gives you ownership in the form of common shares.

Stock Price Dynamics:

If the stock price increases: If the price of Oroco’s shares rises after your purchase, you will see capital gains. For example, if you buy shares at $0.30 and the stock price rises to $1.00, your investment increases by 233%.

If the stock price decreases: Conversely, if the stock price drops below $0.30, you face potential losses. For example, if the stock price falls to $0.10, you would experience a 67% loss. However, the value of your warrants can offset some of the potential losses (explained below).

2. Warrants

A warrant is a call option that gives you the right (but not the obligation) to purchase additional shares of the company at a set price in the future. In this case, the strike price is $0.45 per share, and the warrants can be exercised anytime within 24 months after the investment’s closing date.

Warrant Value: The value of the warrant depends on how the stock price compares to the strike price. If the stock price is higher than $0.45, the warrant has intrinsic value, meaning you can exercise it at a discount to the market price. For example, if the stock rises to $1.00, you can exercise your warrant to buy shares at $0.45, thus realizing a $0.55 gain per share.

Warrant Calculation:

Using the Black-Scholes Option Pricing Model, the current value of the warrant is approximately $0.0644 CAD. This value will increase if the stock price rises above the strike price, offering the investor the potential for substantial gains if the company performs well.

Warrant Value Example

Current Stock Price: $0.30

Strike Price: $0.45

Risk-Free Rate: 4.65% (based on 10-year U.S. Treasury yield)

Volatility: 60% (typical for resource sector stocks)

Time to Expiration: 2 years

Given these parameters, the value of the warrant today is $0.0644 per warrant. If the stock price increases, the value of the warrant will grow, offering additional profit potential for the investor.

3. Leverage with Warrants

Warrants provide leverage in your investment. If the company’s stock price rises significantly, you can exercise your warrant to buy shares at $0.45 per share, even if the market price is much higher (e.g., $1.00). This offers a multiplicative gain compared to the initial $0.30 investment per share.

For example, if Oroco’s stock price jumps to $1.00, the value of your shareholding increases significantly, and your warrant gives you the opportunity to purchase additional shares at a discounted price of $0.45.

This leverage can amplify your returns, especially if the company’s stock price appreciates substantially.

4. Risks Involved

Stock Price Drop: If the stock price falls below the current value of $0.30, your common shares will lose value, and your warrant could become worthless if the price stays below the $0.45 strike price.

Warrant Expiry: Warrants have an expiry date. If you don’t exercise them within the 24-month period, they will expire, and you will lose that potential upside.

However, as long as the stock performs well and increases in value, the warrants provide a valuable option to purchase more shares at a discount, giving you the opportunity to maximize your returns.

The private placement with Oroco Resource Corp. offers an attractive investment opportunity with a combination of common shares and warrants. The shares give you immediate ownership in the company, while the warrants provide additional upside potential if the stock price rises.

Shares offer the potential for capital gains if the stock appreciates.

Warrants provide leverage, giving you the right to purchase more shares at a discounted price if the company performs well.

While the investment carries risks, particularly related to stock price fluctuations, the addition of warrants adds extra value and upside potential, especially in a rising market.

The real quesetion is "how much is the stock Worth?"

Here is my interview on objections on the invesment thesis

The current market capitalization of Oroco Resource Corp. is approximately USD 63.00 million. Respresenting a 2250% upside potential. I invite you to see the first 30 seconds and tell me you dont like the thesis.

My interview explaining $OCO is probably worh $1.48 Billion

Net Present Value (NPV): NPV (8% dicount rate) of US$2.64 billion pre-tax and US$1.48 billion post-tax.

To assess the upside potential of Oroco Resource Corp. ($OCO), it’s useful to compare its current market capitalization with the potential value of its Santa Tomas copper project, as outlined in the Preliminary Economic Assessment (PEA).

PEA Estimated After-Tax NPV:

After-tax NPV (Net Present Value) of the Santa Tomas copper project: $1.48 billion USD (as per the August 24, 2024, update).

Current Market Capitalization:

Oroco Resource Corp.’s current market capitalization is approximately $63 million USD.

Potential Upside Calculation:

The upside potential can be calculated by comparing the current market cap to the after-tax NPV:

23.5X = 1.48 billion PEA results / 63 million Market cap.

Let me say that again 2250% upside

23.5 times you investment as a potential upside:

Based on the updated after-tax NPV of $1.48 billion USD for the Santa Tomas project, Oroco’s stock has an upside potential of approximately 23.5 times its current market capitalization of $63 million USD, assuming the market recognizes the value of the project and the company successfully develops the asset.

This suggests significant potential upside if Oroco is able to unlock the value of the Santa Tomas project and successfully execute its development strategy.

Additional Factors to Consider:

While the 23.5x upside potential is promising, there are several additional factors that could influence the ultimate value and the likelihood of realizing this upside:

Exploration Potential:

Further exploration and drilling could expand the resource base and extend the mine life, which could significantly increase the overall value of the project. New discoveries or a higher-grade copper resource could lead to an even higher NPV.Market Conditions:

The price of copper, which can be volatile, will directly affect the economics of the project. A rising copper price would enhance the project's profitability, while a downturn in prices could hurt its potential. Broader market sentiment toward the mining sector, especially in the context of demand for copper in industries like electric vehicles, will also play a role.Risks:

Operational Risks: The operational challenges of building and running a mine can impact the project's timeline, cost, and profitability.

Regulatory and Environmental Risks: Mining operations must comply with local regulations, and any changes in the legal landscape could affect the project. Environmental concerns could also lead to delays or additional costs.

Geopolitical Risks: Since the Santa Tomas project is located in Mexico, political instability or changes in mining policies could have an impact on the project’s viability.

How much would the stock have to be at closing for a 50% theorical return?

To calculate the stock price at which you would achieve a 50% return on your investment, we need to consider both the value of the common shares and the warrant.

Step 1: Define the Desired Return

You purchased the Unit for $0.30, and you're looking for a 50% return on that investment. The total value of the Unit needs to be:

Target Value=0.30×(1+0.50)=0.30×1.50=0.45 CAD\text{Target Value} = 0.30 \times (1 + 0.50) = 0.30 \times 1.50 = 0.45 \text{ CAD}Target Value=0.30×(1+0.50)=0.30×1.50=0.45 CAD

So, you need the combined value of the common share and the warrant to equal $0.45 on the day you sell or calculate the return.

Step 2: Calculate the Required Stock Price

The value of the Unit consists of:

The common share, which is directly tied to the stock price.

Half a warrant, which gives you the right to buy another share at $0.45.

Since each Unit consists of one common share and half a warrant, let's calculate the stock price required to make the total value $0.45.

Let’s assume the stock price reaches P on Day 1.

Value of 1 share = P (the current stock price).

Value of half a warrant = $0.0644 (which remains the same since it is based on the Black-Scholes model, not on the stock price).

So, the total value of the Unit on Day 1 is:

Total Value=P+0.0644\text{Total Value} = P + 0.0644Total Value=P+0.0644

You want the total value to be $0.45 for a 50% return:

P+0.0644=0.45P + 0.0644 = 0.45P+0.0644=0.45

Now, solve for P:

P=0.45−0.0644=0.3856P = 0.45 - 0.0644 = 0.3856P=0.45−0.0644=0.3856

Conclusion:

To achieve a 50% return, the stock price would need to be approximately $0.39. This would make the combined value of your share and warrant equal to $0.45.

If the stock price exceeds $0.39, your return would be greater than 50%.

UPDATE TWO MONTHS LATER:

The private placement took place at $0.25.

March 3, 2025: Closed a non-brokered private placement, raising gross proceeds of $2,303,555.75 through the sale of 9,214,223 units at $0.25 per unit. Each unit included one share and one share purchase warrant exercisable at $0.40 for 24 months.

Investors who participated in Oroco Resource Corp.'s private placement on March 3, 2025, received units priced at $0.25 each, comprising one common share and one share purchase warrant exercisable at $0.40 for 24 months. To evaluate the total return, including the warrants' valuation, let's assess the stock's performance and the intrinsic value of the warrants as of today, March 25, 2025.

Stock Performance:

Private Placement Price (March 3, 2025): $0.25 per share

Closing Price (March 25, 2025): $0.35 per share

Share Price Appreciation: $0.35 - $0.25 = $0.10 per share

Percentage Gain: ($0.10 / $0.25) * 100 = 40%

Warrant Valuation:

The warrants have an exercise price of $0.40, which is above the current stock price of $0.35. Since the stock is trading below the exercise price, the warrants are currently out-of-the-money and hold no intrinsic value. However, they may still possess time value based on factors like time to expiration and expected volatility.

Total Return Analysis:

Initial Investment per Unit: $0.25

Current Share Value per Unit: $0.35

Unrealized Gain per Unit: $0.10

Percentage Return on Shares: 40%Resource World+2Oroco Resource Corp+2Stock Titan+2

Warrant Value per Unit: $0.00 (intrinsic value)

Total Current Value per Unit: $0.35

Total Percentage Return per Unit: 40%

Note: While the warrants are currently out-of-the-money, they retain potential value if the stock price exceeds $0.40 before their expiration in March 2027. Investors should monitor the stock's performance and consider market conditions when evaluating the warrants' future prospects.