Stock Analysis of Leading Construction Companies in Mexico

Mexico builders seem too cheap for me

Mexico's construction sector is vast and varied, with numerous publicly traded companies offering diverse investment opportunities. In this blog post, we'll delve into a comparative analysis of some of the key players in the sector, evaluating their performance and valuation through various financial metrics.

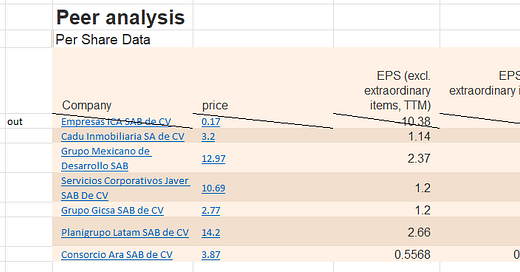

Instead of describing all the metrics, I’ll post an image worth a thousand words:

With a return on the book between 4.7% and 13.9%. PE’s from 2.31 to 8.91, the whole industry seems down on its luck.

We all know by now the bullish arguments for Mexico replacing China slowly but surely:

For several decades, China has been the world's manufacturing hub, attracting many jobs and businesses from around the globe. However, recent economic, political, and social changes suggest that Mexico might be well-positioned to attract more jobs in the future. Here are some compelling reasons to support this claim:

1. Proximity to North America

Shorter Supply Chains: Right next to the USA, the world's largest consumer market, goods produced in Mexico can reach American consumers faster. This reduces shipping times, costs, and overall carbon footprints.

Time Zones: Sharing similar time zones with North American businesses facilitates real-time communication, swift decision-making, and collaboration.

2. Cost-Effective Labor

Competitive Wages: While wages in China have steadily increased, Mexico offers competitive labor costs, making it an attractive destination for businesses looking to optimize costs.

Skilled Workforce: Mexico has invested in education and training programs, producing a skilled workforce proficient in various industries, including automotive, aerospace, and electronics.

3. Trade Agreements and Policies

USMCA: The United States-Mexico-Canada Agreement (USMCA) provides preferential trade conditions among these countries, which can benefit businesses looking to access these markets.

Diverse Trade Partnerships: Mexico has many free trade agreements with over 50 countries, providing businesses greater access to global markets.

4. Geopolitical Stability

Trade Wars: The recent trade tensions between the U.S. and China have made businesses reconsider their over-reliance on one geographical area. Diversifying operations to countries like Mexico can reduce this geopolitical risk.

Predictable Policies: Mexico offers a relatively stable political environment, with policies generally favorable to foreign businesses.

5. Infrastructure and Development

Growing Infrastructure: Mexico has been investing in its infrastructure, including ports, roads, and railways, making transporting goods more efficient.

Special Economic Zones: Mexico has established several Special Economic Zones (SEZs) that offer tax incentives, streamlined customs procedures, and other benefits to foreign investors.

6. Cultural Compatibility with Western Markets

Cultural Ties: With its close cultural ties to the U.S. and Canada, Mexico often offers smoother communication and collaboration channels, reducing misunderstandings and fostering better business relationships.

While China remains a significant player in the global manufacturing scene, Mexico's strategic position and economic and political dynamics make it a strong contender for businesses looking to diversify their operations. As global dynamics shift, Mexico's role as a key player in the international job market is poised to grow… And you know what that means: more construction.

Bear case

The Mexican birth rate experienced a marked decline when NAFTA was introduced and has been on a continuous downward trajectory since. If the aging trend continues, there is a looming threat of a demographic collapse in Mexico by the 2070s.

Recent demographic data further illustrates a substantial reduction in youth, particularly among children and teenagers. This decline can be attributed to three predominant factors: the repercussions of the global financial crisis, the widespread impacts of COVID-19, and the U.S.'s more stringent border policy, which has resulted in an increased number of Mexicans opting to remain in the U.S. Additionally, the persistent drug war, fueled by the U.S.'s high demand for cocaine, has adversely affected family structures and further suppressed the birth rate in Mexico. If these demographic patterns persist, Mexico's situation could become dire by the 2050s, leading to a significant decrease in national capacity as we approach the 2060s.

Do you know any other reasons why this industry should be depressed long-term?

---