Trading has evolved beyond the traditional financial markets. Several platforms have emerged, allowing individuals to trade on various events and outcomes. These platforms are not just for gambling; they can be used as educated metrics of odds. After all, people are betting on these sites with real money, and as they do, prices change. Here are some examples:

1. Hollywood Stock Exchange (HSX)

https://www.hsx.com

The Hollywood Stock Exchange (HSX) is a virtual market where players can buy and sell shares of actors, directors, upcoming films, and film-related options. The prices of these shares fluctuate based on the box office performance of films and the popularity of actors and directors. HSX provides a unique way to gauge the potential success of movies and the star power of celebrities.

2. PredictIt

https://www.predictit.org/

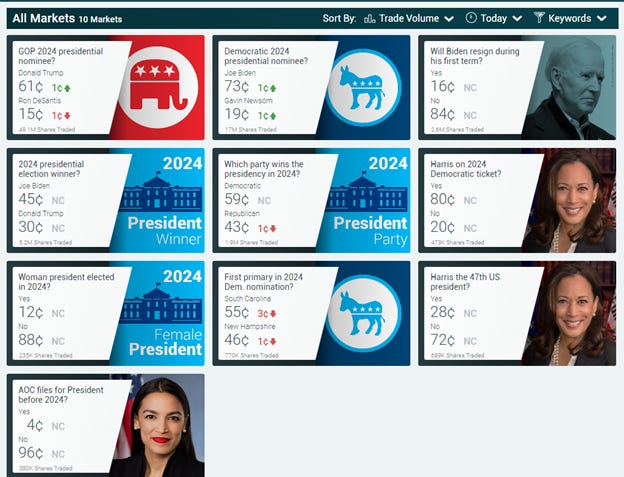

PredictIt is a prediction market platform where users can bet on the outcomes of various events, including political elections, economic indicators, and global events. The prices on PredictIt reflect the collective beliefs of its users about the likelihood of specific events occurring. For instance, if a political candidate's price is 70 cents, the market believes there's a 70% chance of that candidate winning. By observing the price movements on PredictIt, one can gauge its user base's shifting sentiments and beliefs.

The Value of Alternative Trading Platforms

These platforms are not just about making a quick buck. They offer valuable insights into public sentiment and can be used as predictive tools. For instance, political analysts might use PredictIt to gauge public sentiment about election outcomes.

Moreover, those who participate in these platforms are not average. They are often well-informed and have a keen interest in the subject matter. This means that the prices on these platforms reflect the beliefs of a more knowledgeable group, making them even more valuable as predictive tools.

I wish I had more time or data analysts to dive deep into these things, but I’ll give you the million-dollar idea here since I won't do it:

Markets can sometimes overreact due to irrational behavior. Take, for instance, a wager Whitney Tilson suggested that I ultimately placed on the Biden vs. Trump election some years ago. At the time, a Biden victory was priced at $0.65 per share on the market. A win for Biden would yield a $1 per share payout, translating to a 54% profit in 5 days. However, a Trump win would mean a total loss. What made this bet enticing? Considering the discrepancy in the odds from other reputable sources:

FiveThirtyEight gave Biden an 89% chance of winning.

The Economist predicted a 96% win probability for Biden.

The Public Superforecasts, consolidating expert predictions, estimated an 85% chance for Biden.

Where’s the potential opportunity? In comparing prediction models and when outliers appear, the odds may be on your side. Since these markets are illiquid, I think they happen more often than not. This discrepancy in odds presents a potential opportunity for discerning traders.

And if you are wondering, Yes, the bet paid off.

Conclusion

Trading has come a long way from stocks, bonds, and commodities. With the rise of the internet, new platforms have emerged, allowing individuals to trade on almost anything. These platforms provide an opportunity for profit and valuable insights into public sentiment and future outcomes. Whether you're a trader, a filmmaker, or a political analyst, there's a platform out there that can offer you valuable insights.

---