Update on the Thesis: $OCO Oroco’s Santo Tomás Copper Project $0.26... best case 42x?

Oroco Resource Corp's Santo Tomás project in Northwest Mexico presents a compelling asymmetrical opportunity in the copper industry. With a strategic location, favorable infrastructure, efficient capital expenditures, and promising future developments, the project offers significant upside for investors. Below is an update on key developments.

How much more dilution will they need?

It may be as little as US$10 million. A little more with G&A.

1. Strategic Location and Infrastructure Advantages

Santo Tomás is located at the border between the states of Sinaloa and Chihuahua in Northwest Mexico, offering significant benefits due to its proximity to key infrastructure:

Proximity to Ports: The project is 160 km from the deep-water Pacific port of Topolobampo, facilitating copper exports.

Access to Energy: It’s less than 20 km from a high-pressure gas pipeline running from Texas, ensuring a stable energy supply.

Transport and Power: Santo Tomás has access to the Chihuahua-Pacific railway, paved highways, a nearby population center, a hydroelectric dam, and the national power grid, all contributing to reduced capital (CAPEX) and operating costs (OPEX).

Local support is also strong, as the region has a history of mining, with an educated workforce and governmental support, further enhancing the project's potential.

2. Updated Preliminary Economic Assessment (PEA)

The recently updated PEA for Santo Tomás highlights the technical and financial benefits of the project:

Low Strip Ratio: The mineralized body is exposed at the surface, requiring less material to be removed, reducing costs.

Consistent Mineralization: 70% of the copper ore lies in a ridge, making it easier to access and extract.

Low Capex: The updated PEA estimates a relatively low CAPEX of $1.1 billion.

Key Financial Metrics:

Net Present Value (NPV): $1.5 billion (up to $2.8 billion at $4.50 copper prices).

Internal Rate of Return (IRR): 22.2%.

Estimated Copper Production: 5.4 billion pounds over a 20-23 year mine life.

Payback Period: 3.7 years, meaning the project would start generating profits within 4 years.

If copper prices rise to $4.50/lb, the project's NPV could increase significantly to $2.8 billion, translating to approximately $11.20 NAV per share for Oroco’s shareholders.

3. Regulatory Environment in Mexico

Despite strong financial metrics, some market concerns revolve around potential regulatory changes in Mexico. A proposed ban on new open-pit mining concessions raised alarm. However, existing concessions, like Santo Tomás, are unaffected by this proposal.

The project’s mining concession remains in good standing, and under Mexican law, such contracts cannot be altered unilaterally. The newly elected Mexican president, Claudia Sheinbaum, is expected to encourage foreign investment and provide a favorable regulatory environment for mining projects, especially for copper, which is critical for the global energy transition.

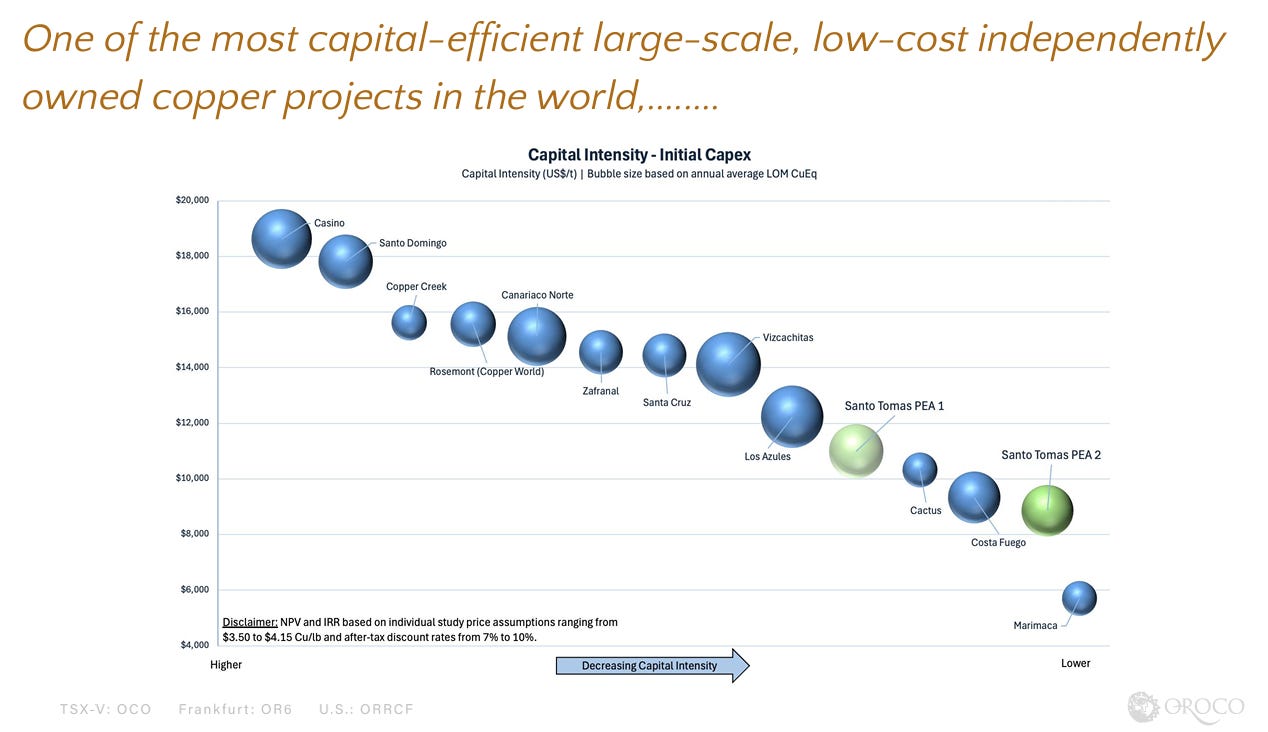

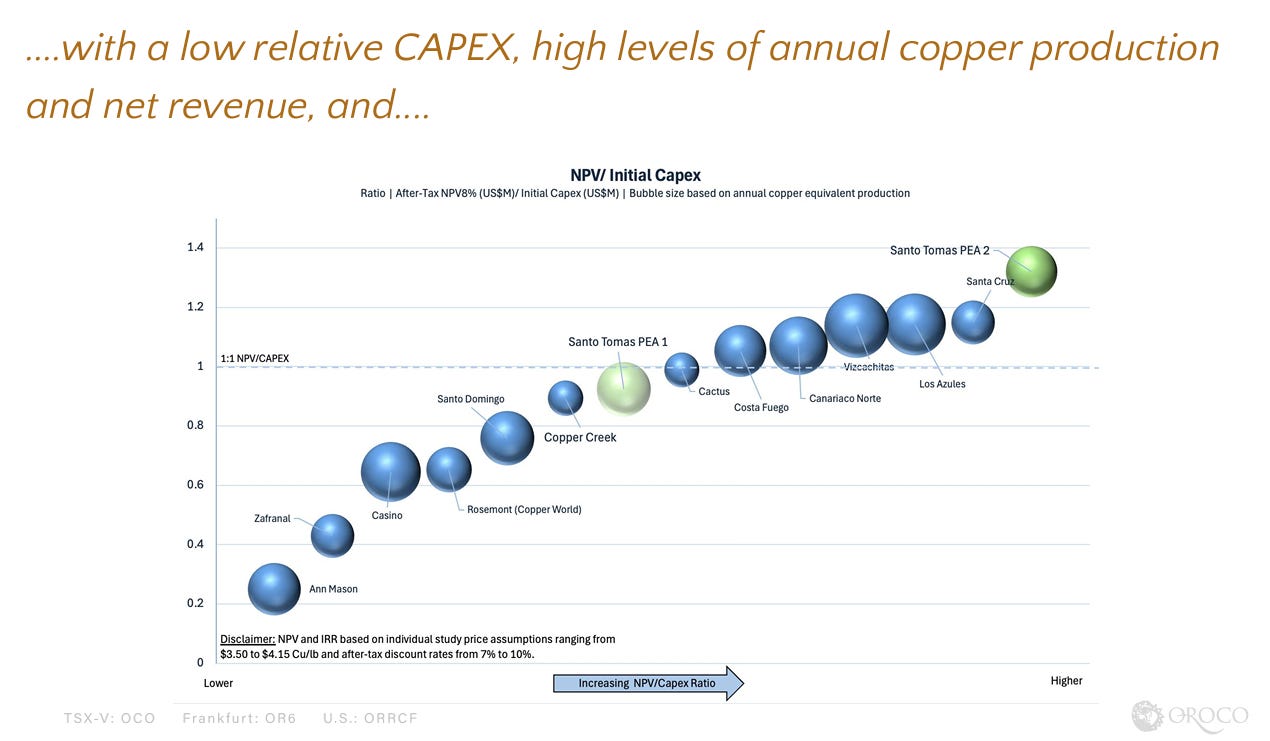

4. Capital Efficiency and Industry Comparisons

One of Santo Tomás’ most compelling advantages is its capital efficiency. The CAPEX required per ton of annual copper production is under $10,000, which is significantly lower than its peers, where costs range from $20,000 to $40,000 per ton. This makes Santo Tomás one of the most capital-efficient independently owned copper projects in the world.

This efficiency makes the project attractive to major mining companies, which remain cautious about capital expenditures following previous industry overspending. Santo Tomás offers fewer risks of cost overruns, positioning it as a project that majors are likely to view favorably.

5. Upcoming Catalysts

Several important catalysts are expected in the coming months, which could drive further value:

Phase 2 Drilling Program: After completing Phase 1 drilling (76 holes), Oroco plans to launch Phase 2 to expand the resource base and upgrade resource confidence from "inferred" to "measured and indicated."

Additional Investment: Oroco anticipates a funding round to finance the second phase of drilling.

Political Clarity: With the new government in Mexico under President Sheinbaum, there’s hope for a clearer and more favorable regulatory framework for mining, particularly in copper.

Conclusion

Oroco’s Santo Tomás project offers a unique asymmetrical investment opportunity. Its strategic location, capital efficiency, and the improving political environment in Mexico position it as a highly attractive prospect. As the global demand for copper increases, particularly for renewable energy and electric vehicle industries, Santo Tomás is well-positioned to capitalize on these trends. Investors should watch for upcoming catalysts, including further drilling and regulatory developments, which could unlock additional value.

This update underscores the significant potential for long-term growth and profitability in this project. Stay tuned for more developments.

Here is my one liner today:

“They invested CAD$70M in the last 4 years. You can buy the stock today for a market cap of CAD$ 80M… no debt. High uncertainty on timing. Good fundamentals. Engineers say it’s worth $11/stock with a $4.5 copper price (today, not accounting for future dilutions or discoveries. His uncertainty, huge risk reward. I'm willing to seat on this for years if necessary because for Each 1% rise in copper price delivers a 3.7% rise in post-tax NPV and we need a lot more copper. A lot of people worry about politics, if Mexico turns into a dictatorship I would agree, but it's not (I can only argue about facts today not imaginary escenarios in someone’s mind). One thing Id learned from history is that politics are also ruled by the laws of economics … and there’s a lot of money in the mining industry”